The emergence of blockchain technology is emerging as an awe-inspiring catalyst in the ever-evolving domain of finance, profoundly changing the very nature of the sector. Join us on an amazing journey to discover blockchain's limitless possibilities in transforming the financial landscape into one that is faster, more impermeable, and more economically effective. Traditional financial systems have long been known for their complexities, reliance on middlemen, and inherent incompetence. However, blockchain technology is developing as a revolutionary force, promising to streamline procedures, reduce costs, and increase transparency. In this enthralling story, we'll look at how blockchain is poised to cause a seismic shift in the world of money.

The Power of Decentralization

The decentralized

foundation of blockchain is at the heart of its impact on the world of finance.

Blockchain flourishes within a peer-to-peer network, unlike traditional

financial systems that rely on middlemen such as banks. This outstanding feature

eliminates the need for intermediaries, resulting in lower transaction costs

and faster processing.

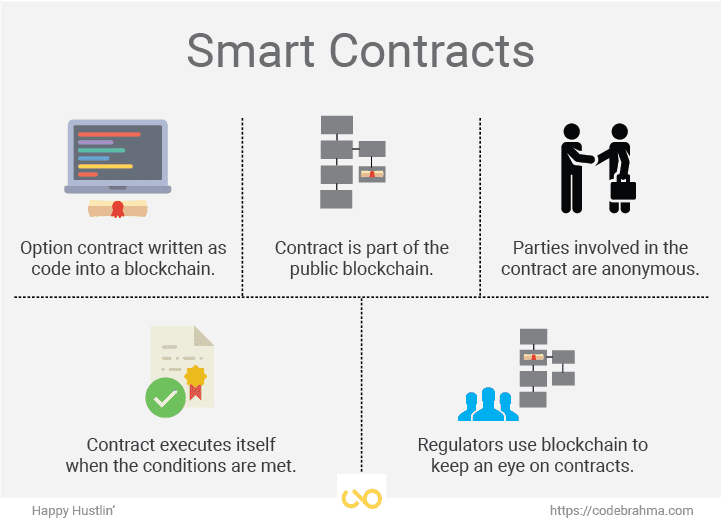

Smart Contracts

Blockchain's

inventiveness extends far beyond transactions. Intelligent agreements, also

known as smart contracts, have the extraordinary capacity to execute

contractual obligations autonomously by direct coding of the contract terms.

This automation simplifies operations and reduces the need for human

participation in financial transactions. As a result, it not only saves time

but also serves as a precaution against potential errors.

Enhanced Security

Blockchain's security

features benefit both financial institutions and their customers. Its

unchanging and transparent registry is a tremendous barrier against deception.

Each transaction is scrupulously documented across a network of nodes, ensuring

records that are impregnable to alteration.

Global Accessibility

Blockchain operates

without regard for geographical boundaries. As a result, both people and

organizations can conduct smooth global transactions without having to deal

with the time-consuming formalities and fees associated with traditional

banking systems.

Cost Reduction

The impact of

Blockchain is simply astounding since it significantly reduces operational

costs by eliminating intermediaries and optimizing processes. This opens up a

fantastic chance to reduce costs, hence improving access to financial services

for individuals who have hitherto been marginalized.

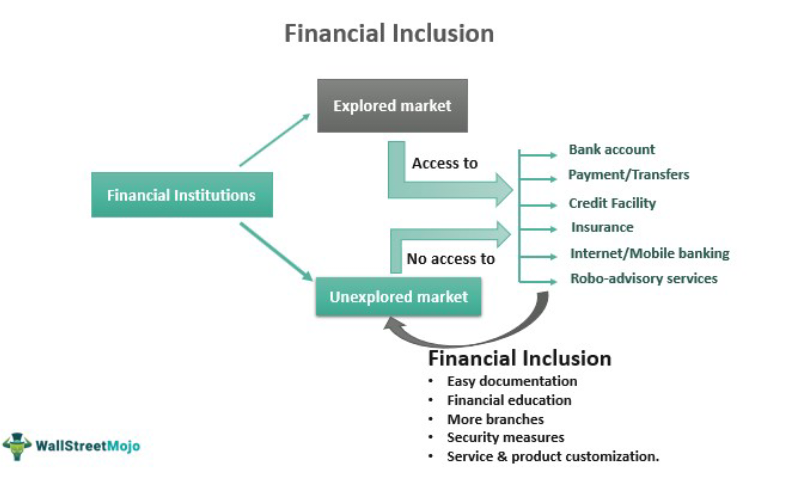

Financial Inclusion

Blockchain's limitless

promise stems from its capacity to transcend barriers and welcome all

individuals, regardless of financial situation. By overcoming the limits

imposed by traditional banking systems, blockchain enables the unbanked and

underbanked to access the entire range of financial services. As a result, this

breakthrough technology can potentially improve living circumstances and spark

economic improvement in underserved areas.

Challenges Ahead

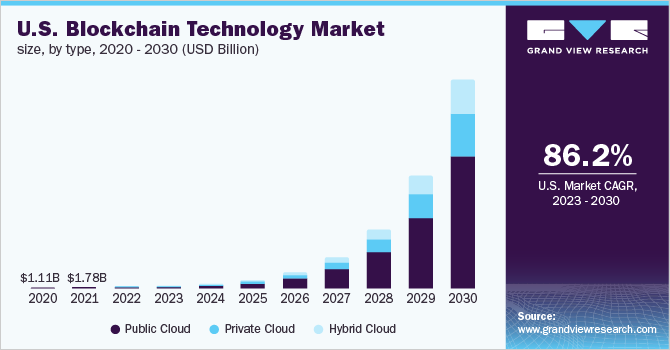

Despite the obvious

benefits of incorporating blockchain into the sphere of banking, there are

significant challenges that must be overcome. Expandability, the establishment

of regulatory frameworks, and the attainment of universal acceptance all prove

to be formidable obstacles that require immediate attention in order to fully

unlock the limitless potential of blockchain technology in the financial

domain.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Blockchain is more than

just a technological innovation; it represents an amazing force with the

potential to totally revolutionize the financial landscape. With financial

institutions and pioneers excitedly delving into and exploiting blockchain's

vast potential, we are on the verge of a financial revolution that promises a

speedier, more cost-effective, and all-encompassing future for every

individual.

"Blockchain: Shaping finance's future, where speed meets efficiency, ushering in a new era of secure, accessible, and borderless transactions."